Couples and money are not always a good recipe for a happy marriage. Do you understand how your partner thinks about money? Do you understand how you think about money? Are you financially in sync with your partner? Do you have a financial map that combines your household finances? If you can’t answer “yes” to all these questions, read on. Money is one of the topics most couples argue about. Arguments surrounding money can be a result of many things – different views about money and its purpose, feelings of guilt or uncertainty, not having a household finance plan, or simply not having the time, desire and energy to make finances a priority. It’s ideal to have the “money talk” before saying “I Do” but it’s never too late to get started. Planning to buy a home or welcoming a new baby are perfect reasons to begin the money talk if you haven’t done so already.

It’s critical to gain an understanding of your finances together before financial distress takes over. Money conflicts come at a cost. Stress-related health problems, insecurity about the future, emotional and spiritual depletion, pressure to work and earn more, and heavy debt burdens are examples. Start to build a solid financial foundation now by carving out some special time together every week. Begin by exploring the following questions in your “money talk.”

- What is your biggest money fear?

- In what ways should we “live for today” and in what ways should we “save for tomorrow”?

- What did you learn about money from watching your parents?

- Were you rich or poor growing up? In what ways?

- If you found out you only had five years left to live, what would you want to do with it?

- How would you like us to handle money better?

- Name something you bought, but wish you hadn’t. Are there ways we can help each other prevent this in the future?

- What would we do if family members or friends ask to borrow money?

- What amount of money should each of us be comfortable spending without consulting the other?

- What is our biggest financial challenge?

- How should we handle making big purchases?

- How should we pay our daily living expenses?

- Should we combine our money or have separate accounts?

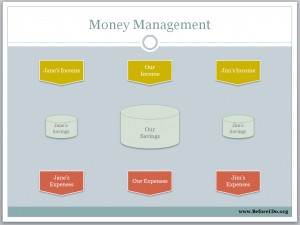

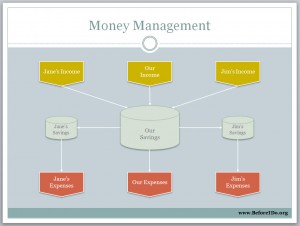

These questions offer you a starting point. Add to the list questions relating to your specific situation. Maybe you want to find clarity and set boundaries on how to pay for expenses relating to your home, children, hobbies, gifts or vacation. Once you tackle these questions and gain a better understanding of how each of you individually, and as a team, approaches your finances you will be better suited to create a household finance map. It’s important to note that there is no right solution. Every couple is unique and therefore has a unique solution and finance map. Your finance map is a one-page navigation tool that depicts how to pay joint expenses and individual expenses in addition to building your savings. Here’s a basic blank template courtesy of www.beforeido.org.

The idea is to draw arrows from the income in row one to the checking and savings accounts in row two and from the expenses in row three to the checking and savings accounts in row two. You can start at the top and move down the page or you can start at the bottom and work up. This process will help you decide whether having one joint account is sufficient or if you should have separate accounts in addition to a joint account. Here’s an example of a plan involving the use of joint and individual accounts to cover all expenses. All the income is deposited into the joint savings account. Joint expenses are paid directly from the joint savings account. Transfers are made from the joint savings account to each individual savings account to cover individual expenses. In your own diagram you may want to include dollar amounts for the income received, transfer amounts and expenses. Once you have your household finance map in place automate all the transfers and you will be living a stress-free financial life.

As life changes your financial map will need some tweaking so keep on top of the plan and adjust when needed. A good practice is to review your map once a year, on New Year’s Day or your anniversary, and plan the year ahead. You’ll reap the rewards of building a stronger relationship with each other, and money, leading to a brighter future filled with harmony, confidence and freedom to enjoy the other parts of your life. If you need help creating a household finance map or discussing the “money talk” questions seek out a neutral third party such as a financial planner or financial coach who is experienced in this area.

I’d like to hear your thoughts on couples and money, what’s working best for you and what challenges you have overcome.